Qualify more renters and

increase NOI

Qualify more renters and increase NOI.

From lead to lease, save time, money and headaches while avoiding bad debt.

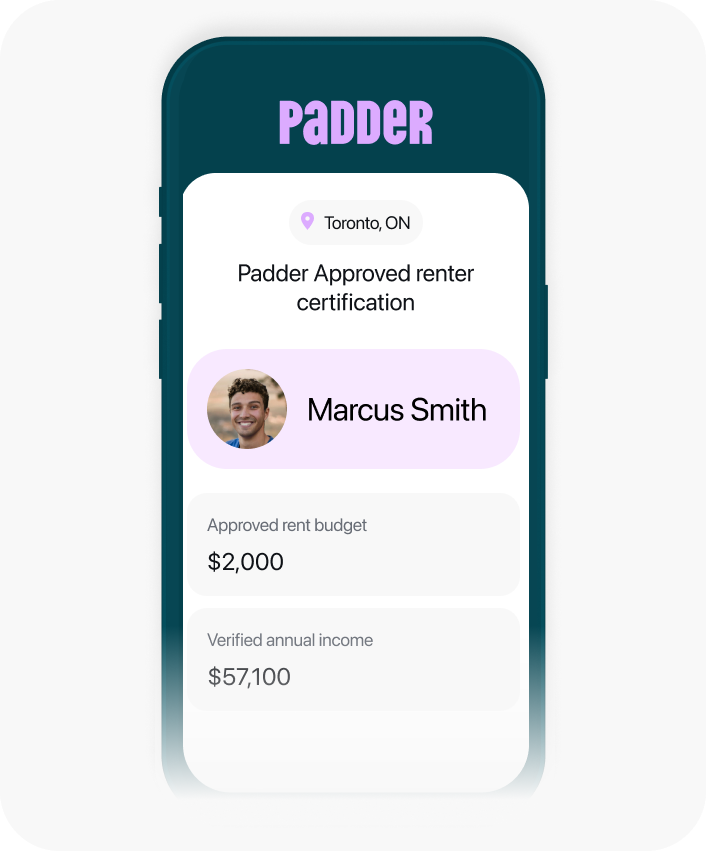

Qualify more renters

The assurances you need to quickly qualify modern-day renters.

Increase NOI

Increase leasing velocity with products that save your team time and money.

At no cost to you

Padder product fees are covered by tenants at lease signing.

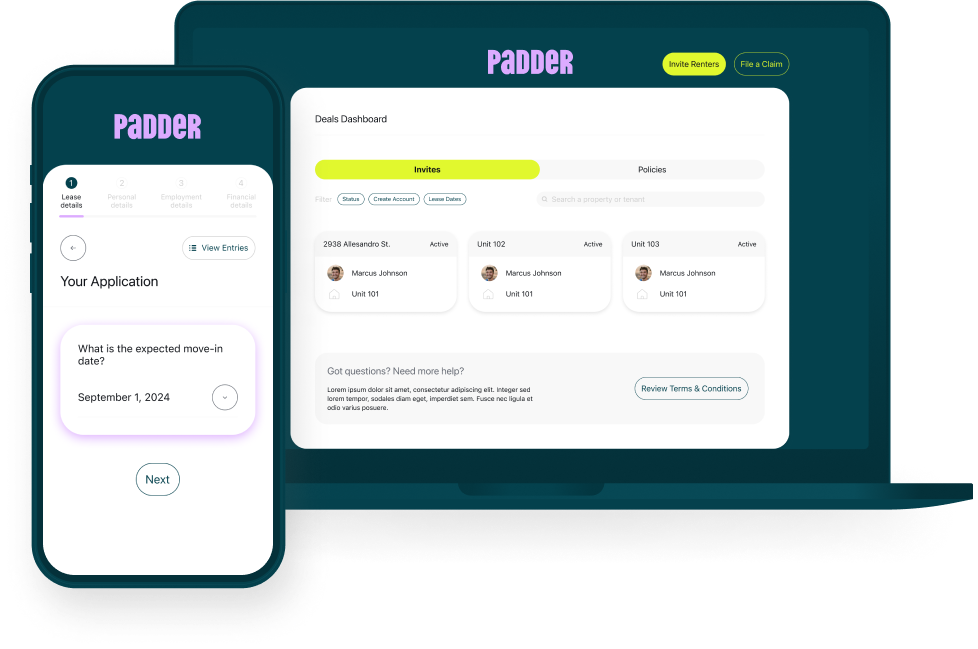

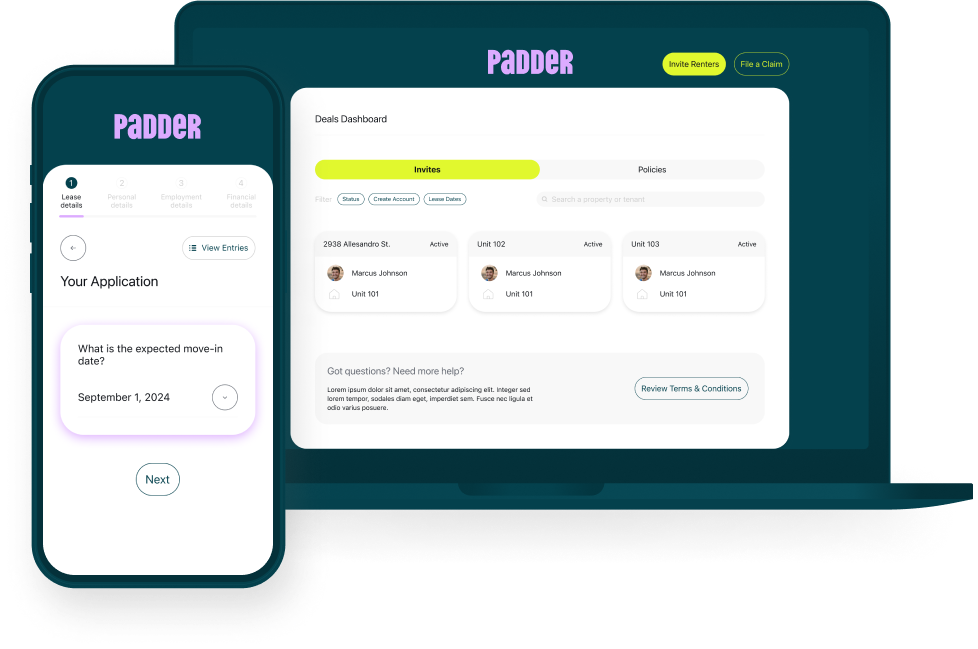

How it works

1

Tenants submit an application to qualify for Padder Guarantor.

2

Tenants pay a one-time fee to purchase their Padder Policy.

3

Your rental is protected from rent default.

Products built for rentals

Meet your renting superpowers

Run a more profitable rental operation and increase accessibility for renters.

Your bottom line protector

Realize your rent potential

Don’t qualify for the place you want? Padder can help you get in the door.

We help you improve your KPIs and minimize debt with every rental.

Number of units

Average Rent

Rent Guaranteed

Minimize bad debt up to

50%

Increase access for renters and minimize your rent roll risk.

Boost lease conversions up to

20%

Fill vacancies faster while offering tenants more flexibility.

Increase protection up to

5x

Increase your bottom line with guaranteed rental income.

Find the right

tenants

Our leasing experts work hard to process applications quickly. We are available to answer your questions from Monday to Saturday between 9 a.m. and 6 p.m EST.

Contact us directly

Without Padder, I wouldn’t have been able to afford my current home. Despite having a steady income, the initial rental deposit was more than I had saved up, and there was no one I could ask to be my guarantor.

Shota Fujimoto

Freelancer

“Using Padder Guarantor has helped us qualify more applicants and reduce vacancies. Their claims team moves quickly and their customer service representatives are always on top of things.”

"With Padder, my clients are able to secure their desired rental without having to pre-pay rent. It saves them thousands, and makes sure my renters get the home they want."

"Padder helped us lease up our newest project 30% faster than usual. We are able to qualify more applicants, which helped us reduce costs while protecting our bottom line."

Backed by the best

Backed by the industry’s best

Our established insurance providers have been protecting Canadians for nearly 20 years. Coverage is provided by an insurance company currently rated A- (excellent) by A.M. Best.

We’re here to answer your questions

What is Padder Guarantor?

Padder Guarantor is a tailored lease guarantee that ensures tenants meet their lease obligations throughout their tenancy. By purchasing this guarantee, renters can qualify for a home they might not otherwise be eligible for. The guarantee provides financial protection to landlords, covering rent payments in case a tenant defaults—though the renter remains responsible for those payments to Padder.

Who Pays for Padder Guarantor?

The renter does. Pricing is determined through an underwriting process and aligns with regulator-approved rates, typically ranging from 25% to 130% of one month’s rent

How Long Does the Guarantee Last?

The Padder guarantee, activated with the purchase of Padder Guarantor, aligns with the term of the lease, up to 36 months, ensuring uninterrupted rent payment protection for both tenants and landlords.

What Does Padder Guarantor Cover?

Padder Guarantor offers landlords up to 36 months of lease protection, covering:

Getting started is simple. Contact us HERE – there’s no cost or commitment to sign up. Our team is ready to support you with hands-on training and guidance. Think of us as your dedicated partner every step of the way.

- Up to 12 months’ of rent

Getting started is simple. Contact us HERE – there’s no cost or commitment to sign up. Our team is ready to support you with hands-on training and guidance. Think of us as your dedicated partner every step of the way.

Padder Underwriting Inc. arranges coverage for tenants and landlords in provinces where it is licensed to offer insurance products.

Coverage is provided by an insurance company currently rated A- (excellent) by A.M. Best.

We raised $2.5M to make renting accessible