The key to your next commercial space

Padder helps you qualify for your next lease without large deposits and letters of credit.

Working for Businesses

RETAIL

I can’t afford to pay

8-months upfront.

manufacturing

We don’t want to get

a letter of credit.

Wholesaling

We don’t want to

borrow our deposit.

startup

We don’t want to get

a letter of credit.

RETAIL

I can’t afford to pay

8-months upfront.

manufacturing

We don’t want to get

a letter of credit.

Wholesaling

We don’t want to

borrow our deposit.

startup

Our new startup doesn’t qualify.

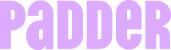

It’s simple to get started

1

Fill out our questionnaire and upload a few documents.

2

Qualify to move into your new rental in as little as 30 minutes.

3

Get approved for the space you want without breaking the bank.

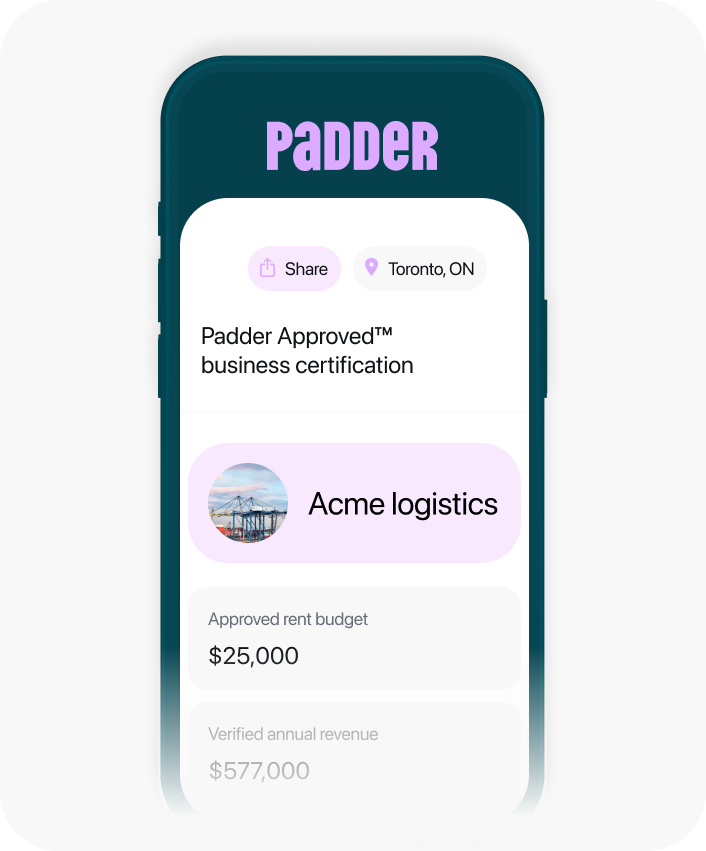

Realize your rent potential

The key to your new home

Padder makes it easy to secure your next commercial space.

Your Business Income

Without Padder

With Padder

Getting you approved

is our priority

Contact us directly

Secure the keys to your new space

Our products unlock financial flexibility for your business.

Without Padder, I wouldn’t have been able to afford my current home. Despite having a steady income, the initial rental deposit was more than I had saved up, and there was no one I could ask to be my guarantor.

Backed by the best

Our established insurance providers have been protecting Canadians for 30 years. Combining cutting-edge technology, best-in-class support, and comprehensive coverage to support every aspect of your leasing process.

How we compare

- Free-up working capital

- No operating restrictions

- Short application process

- No bank account minimum

- Interest free

| Cash deposit | Letter of credit | Financed deposit |

|---|---|---|

| X | X | ✓ |

| ✓ | X | X |

| ✓ | X | X |

| ✓ | X | X |

| ✓ | ✓ | X |

We’re here to answer your questions

What is Padder Lease Protection?

Padder Lease Protection helps you secure your ideal commercial space without the burden of a large upfront cash deposit or letter of credit. Padder Lease Protection provides financial protection for your landlord in case of a default. If a reimbursement request is made Padder reimburses the landlord for the loss.

How Much Does Padder Lease Protection Cost?

The cost varies based on factors like the level of protection required by the landlord, and your business’s financial profile. After submitting an application, you’ll receive a customized price tailored to your specific needs. This ensures fair, competitive pricing—offering a more affordable alternative to a traditional cash deposit while keeping your credit available for business growth, unlike a letter of credit.

What Are the Benefits of Padder Lease Protection for Tenants?

Financial Flexibility: Avoid locking up large sums in cash deposits or letters of credit, so you can invest in growing your business instead.

Stronger Lease Applications: Secure your lease with a solution that offers landlords greater protection than a cash deposit or letter of credit, making your application more attractive.

What are the steps and timeline for the Padder Lease Protection application process?

- Your landlord invites you via email to apply.

- Submit your application and upload required documentation, such as government-issued ID(s) and financial statements.

- If certain criteria are met, we will email you with an approval decision. This can take up to 24 hours from the time you apply.

- Padder Protection is added into your lease, and you are ready for move-in!