Qualify more tenants and increase NOI

Padder helps landlords improve leasing velocity and protect the bottom line by guaranteeing the lease.

Maximize

protection

Padder protects your properties from missed rent, legal fees, vacancy and more.

Qualify more

tenants

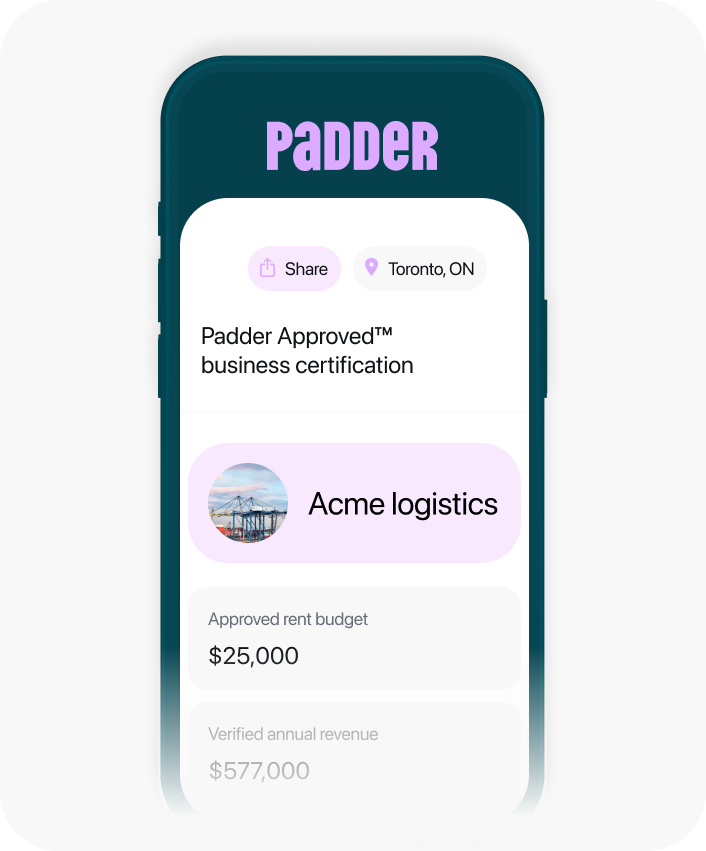

The assurances you need to quickly qualify your next commercial tenant.

Increase

NOI

Increase leasing velocity with products that save your team time and money.

How it works

1

Choose the right coverage for your property and invite your tenant to apply.

2

Tenants pay a fee for their coverage and satisfy their move-in requirements.

3

Your property is protected against unpaid rent, legal costs, and vacancy.

The key to a more profitable leasing operation

Leasing with Padder increases velocity and protects your bottom line.

Find the right

tenants

Our leasing experts work hard to process applications quickly. We are available to answer your questions from Monday to Saturday between 9 a.m. and 6 p.m EST.

Without Padder, I wouldn’t have been able to afford my current home. Despite having a steady income, the initial rental deposit was more than I had saved up, and there was no one I could ask to be my guarantor.

Backed by the best

Our established insurance providers have been protecting Canadians for 30 years. Coverage is backed by an insurance company currently rated A- (excellent) by A.M. Best.

How we compare

- Increased leasing velocity

- Tenant insolvency protection

- Short application process

- Vacancy protection

- No admin overhead

| Cash deposit | Letter of credit | Financed deposit |

|---|---|---|

| X | X | X |

| X | ✓ | X |

| ✓ | X | X |

| X | X | X |

| ✓ | ✓ | X |

We’re here to answer your questions

What is Padder Lease Protection?

Padder Lease Protection is designed to replace or supplement traditional cash deposits for commercial leases. It provides financial security for landlords while helping tenants preserve business capital and maintain financial flexibility.

Instead of paying a large cash deposit, tenants purchase Padder Lease Protection, ensuring landlords receive protection of up to 12 months’ rent. This includes protection for unpaid rent, legal fees, and costs associated with vacancy and re-leasing—offering peace of mind and a seamless leasing experience.

Who pays for a Padder Lease Protection?

The renter does. Pricing is determined through an underwriting process and aligns with regulator-approved rates. Padder Lease Coverage provides financial protection to landlords while allowing tenants to secure their commercial space without tying up large amounts of capital.

How long does Padder Lease Protection last?

What does Padder Lease Protection cover?

Padder Lease Protection offers landlords up to 12 months of protection, covering:

- Unpaid rent

- Legal expenses

- Vacancy and re-leasing costs

Getting started with Padder is simple. Contact us at partners@padder.com – there’s no cost or commitment to sign up. Our team is ready to support you with hands-on training and guidance. Think of us as your dedicated partner every step of the way.